My two sons are now 8 and 5 (almost 6), and they’ve never received an allowance. Nor do we have any plans to start one in the future. They only earn spending money by doing chores. This is how we have emphasized money management and kids taking ownership of managing that money.

|

| Image courtesy of pixabay.com |

This is not what I planned. I always thought that after they got to a certain age (5 or 6), we’d start giving them a weekly allowance that would gradually increase as they got older. The allowance would be automatic, unless they broke an important rule or got in trouble in school, in which case we’d withhold it. That’s how I was raised, and I assumed that’s how we would raise our kids.

My husband had other ideas.

When our older son was 6, we started discussing the issue of allowances versus chores. I argued in favor of an allowance, having read that you shouldn’t tie chores to money because helping around the house is part of being a family, not a “job.” My husband argued that by paying per chore, we would be teaching them good money management and kids would be instilling a solid work ethic.

When our older son was 6, we started discussing the issue of allowances versus chores. I argued in favor of an allowance, having read that you shouldn’t tie chores to money because helping around the house is part of being a family, not a “job.” My husband argued that by paying per chore, we would be teaching them good money management and kids would be instilling a solid work ethic.

Enter Dave Ramsey.

Ramsey writes and speaks about family money management, and he’s famous for saying that Americans are “in love with debt.” He claims this is the root of our financial problems. His tactics teach you to live within your means and pay down your debt.

Several years ago, we realized it was time for us to take debt and spending seriously, so we read a couple of Ramsey’s books. His methods have helped us tremendously, and I want to teach money management to my kids so they don’t make the money mistakes I did when I was younger.

Ramsey frequently talks about kids and money. He and his daughter both argue that chores are an excellent way to teach children basic money management and kids skills.

“Chores” in our house are not routine tasks, such as the boys picking up their room or their toys, but things that we parents would normally do (dishes, laundry, etc.) that they can do to save us time and earn themselves money.

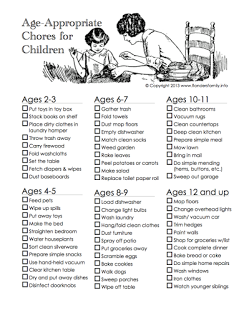

Our kids get paid by the job or by the hour, depending on whether the job has a pre-set rate. We keep a simple chart on our fridge of various age-appropriate chores and how much they are worth. Examples are dusting (50 cents a room), folding a basket of laundry (75 cents), and scrubbing a bathroom ($1.00).

When they do other jobs, such helping my husband take down Christmas lights last month, they are paid $4.00/hour. They keep track of each job on the chore chart on the fridge, and we pay them in cash each Friday. They both have plastic money jars that they use to save up for purchases.

It’s been a big success, and these are the most important lessons on money management and kids we have learned about, so far. Each of these are lessons I hope they carry into adulthood.

Money Management and Kids

|

| My older son’s first “big” purchase with his own money. |

1. Work Ethic: Earning Money is Hard

Kids know that adults “work,” but they usually don’t know exactly what this means. Whether you work inside or outside the home, kids rarely understand exactly what their parents do for a living. Naturally, they also don’t understand why work can be rewarding or tedious or difficult, or why we bother with it at all.

When kids work for money, they begin to understand what we do and why we do it. Instead of assuming that Mom and Dad will buy them anything they want, they start to realize that money is a limited resource and something that only comes from doing work.

This helps them empathize with a parent who needs to stay late at work or take a few minutes after supper to send e-mails. It also helps prepare them for their first jobs outside the home in their teen years such as babysitting, mowing lawns, or working retail.

2. Delayed Gratification: Saving Up for Something Special

How many times has your kid seen something in a store or in a commercial and just “had to have it”? I’ve often let my kids get something off of the $1 shelf at Target that they suddenly “needed,” only to see it forgotten within a couple of days.

When a child earns her own money for something, she’s learning patience instead of instant gratification. She’s learning the crucial skill of delayed gratification, which is a predictor of later success. The child who learns delayed gratification does better in school and makes more mature choices in life than the child who wants (and gets) everything he wants right away.

My 8-year-old is currently saving up $50 for a Star Wars Light Saber kit. He’s been saving for over a month now and is just a few dollars short of his goal. A month is a long time in the life of a young child, but he’s been patiently working and saving up his money. In the meantime, he’s drawn up plans for the types of light sabers he will build and how he will “fight” with them.

Imagining playing with this toy has taught him patience and spurred his creativity, much more than if we’d just bought it for him as soon as he mentioned it.

3. Decision-Making: The Hard Choices

A child saving up money for weeks will be tempted by opportunities to spend the money before they’ve reached their goal. Frequently, my kids will think of something smaller that they want — such as a small toy or candy treat in a store. I give them the choice of using some of their money for this new item, or continuing to save up for the thing they’ve been anticipating.

My almost-6-year-old will often choose the smaller thing, but not always. Or perhaps he’ll compromise and get a $1 treat instead of a $5 one. Since it’s his money, we let him make that choice, but then he realizes it will take him longer to reach his goal.

My older son almost always chooses to keep saving his money. When he recently asked me to spend $3 on a Star Wars game app for my tablet, I told him that I thought he should use his own money for it. He said, “It’s not worth it.” In that moment, he learned more about money management than I could teach him by just explaining the principles of wants versus needs.

4. Pride in Accomplishments: The Thrill of Success

Children, like adults, take pride in a job well done. Doing chores has long-term psychological benefits because they like it when we trust them enough to let them help us. My older son takes pride in his dusting abilities; my younger son brags about how good he is at cracking eggs without getting pieces of shell in our baking.

We’re used to thinking of housework and cooking as tedious, but for children, it can be a fun challenge and a boost to their self-esteem. They spend their young lives aware that they can’t do everything we can; so when they learn a new skill, especially one that helps out mom and dad, they are enormously pleased with themselves.

Final Tip: Be A Coach, Not a Boss.

If they’ve “scrubbed the bathroom,” and the sink is still covered in toothpaste, it’s hard to resist the urge to get annoyed and tell them they did it all wrong. However, too much criticism can backfire. If a child becomes so afraid of criticism that they don’t want to help, then what you’re doing with money management and kids is not the right lesson.

It’s important to think of yourself as a coach, not a boss, when giving your child chores. A boss gives orders, but a coach teaches someone how to do something; they encourage practice and expect mistakes along the way. A coach leads by example, demonstrating as well as instructing. Likewise, in the above example, the right response is not, “How did you miss the toothpaste?! This bathroom isn’t clean at all!” That comment guarantees that your child will not want to clean the bathroom in the future.

Instead, say, “I see you’ve worked really hard to clean the bathroom. But we need to make sure the sink is clean, too, and dried toothpaste is tricky. Let me show you what you need to do to get this off, too.”

If you haven’t encouraged or paid your child to do chores in the past, it’s not too late to start. You’ll find the benefits start with money management but help develop your child’s character, too. And your house might end up a little less dusty. Everybody wins with money management and kids playing nicely!

Category: Family FinancesTags: allowance